How Do Property Taxes Work In Arkansas . The appraised value is equal to the. People who work for the county go around and. How do property taxes work in arkansas , though?. Property taxes are levied by local school districts and approved by the quorum court. The median property tax in arkansas is $532.00 per year for a home worth the median value of $102,900.00. The amount of property tax owed is based on the assessed value of the property, which is determined by the county assessor. How property taxes work in arkansas. Our arkansas property tax calculator can estimate your property taxes based on similar properties, and show you how your property tax. Property in arkansas is regularly appraised by professional appraisers that are designated by the state. In arkansas, property taxes are based on the market value of a person's property. Counties in arkansas collect an. Property owners in arkansas have the legal obligation to pay property taxes every year.

from www.dailysignal.com

Property owners in arkansas have the legal obligation to pay property taxes every year. The median property tax in arkansas is $532.00 per year for a home worth the median value of $102,900.00. How property taxes work in arkansas. Property taxes are levied by local school districts and approved by the quorum court. People who work for the county go around and. Property in arkansas is regularly appraised by professional appraisers that are designated by the state. Our arkansas property tax calculator can estimate your property taxes based on similar properties, and show you how your property tax. How do property taxes work in arkansas , though?. The amount of property tax owed is based on the assessed value of the property, which is determined by the county assessor. In arkansas, property taxes are based on the market value of a person's property.

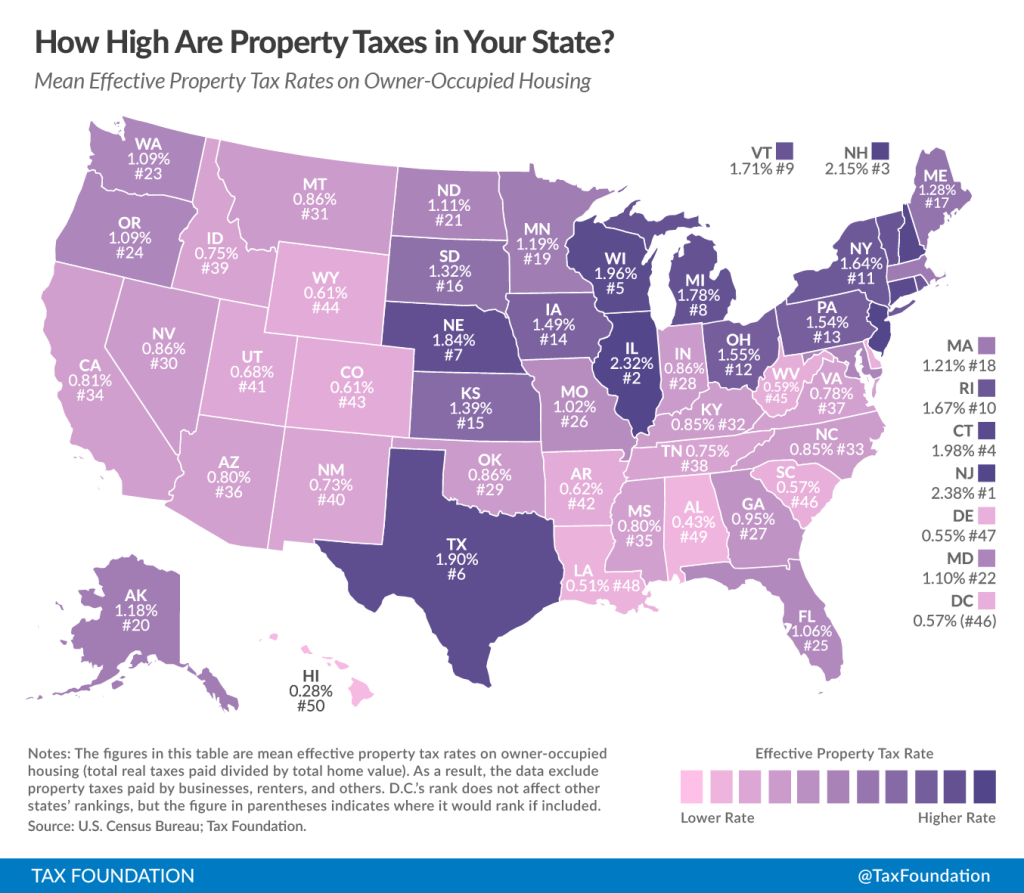

How High Are Property Taxes in Your State?

How Do Property Taxes Work In Arkansas Counties in arkansas collect an. Property in arkansas is regularly appraised by professional appraisers that are designated by the state. Property taxes are levied by local school districts and approved by the quorum court. Our arkansas property tax calculator can estimate your property taxes based on similar properties, and show you how your property tax. Property owners in arkansas have the legal obligation to pay property taxes every year. The appraised value is equal to the. In arkansas, property taxes are based on the market value of a person's property. The amount of property tax owed is based on the assessed value of the property, which is determined by the county assessor. How property taxes work in arkansas. Counties in arkansas collect an. People who work for the county go around and. How do property taxes work in arkansas , though?. The median property tax in arkansas is $532.00 per year for a home worth the median value of $102,900.00.

From www.taxuni.com

Arkansas Property Tax How Do Property Taxes Work In Arkansas How do property taxes work in arkansas , though?. Our arkansas property tax calculator can estimate your property taxes based on similar properties, and show you how your property tax. In arkansas, property taxes are based on the market value of a person's property. Property owners in arkansas have the legal obligation to pay property taxes every year. Counties in. How Do Property Taxes Work In Arkansas.

From www.uaex.uada.edu

Arkansas Property Taxes How Do Property Taxes Work In Arkansas In arkansas, property taxes are based on the market value of a person's property. Our arkansas property tax calculator can estimate your property taxes based on similar properties, and show you how your property tax. Property in arkansas is regularly appraised by professional appraisers that are designated by the state. The median property tax in arkansas is $532.00 per year. How Do Property Taxes Work In Arkansas.

From dollaroverflow.com

How Do Property Taxes Work in 2024? How Do Property Taxes Work In Arkansas In arkansas, property taxes are based on the market value of a person's property. People who work for the county go around and. Counties in arkansas collect an. How property taxes work in arkansas. How do property taxes work in arkansas , though?. Our arkansas property tax calculator can estimate your property taxes based on similar properties, and show you. How Do Property Taxes Work In Arkansas.

From www.pinterest.com

How Do Property Taxes Work in Texas Ebook Property tax, Ebook, Texas How Do Property Taxes Work In Arkansas People who work for the county go around and. The median property tax in arkansas is $532.00 per year for a home worth the median value of $102,900.00. Property taxes are levied by local school districts and approved by the quorum court. The amount of property tax owed is based on the assessed value of the property, which is determined. How Do Property Taxes Work In Arkansas.

From www.uaex.uada.edu

Arkansas Property Taxes How Do Property Taxes Work In Arkansas The median property tax in arkansas is $532.00 per year for a home worth the median value of $102,900.00. In arkansas, property taxes are based on the market value of a person's property. Property in arkansas is regularly appraised by professional appraisers that are designated by the state. How do property taxes work in arkansas , though?. How property taxes. How Do Property Taxes Work In Arkansas.

From propertyownersalliance.org

How High Are Property Taxes in Your State? American Property Owners How Do Property Taxes Work In Arkansas The appraised value is equal to the. People who work for the county go around and. How do property taxes work in arkansas , though?. Property in arkansas is regularly appraised by professional appraisers that are designated by the state. In arkansas, property taxes are based on the market value of a person's property. Property taxes are levied by local. How Do Property Taxes Work In Arkansas.

From www.uaex.uada.edu

New Reports Highlight Arkansas’ Varied Property Tax Landscape How Do Property Taxes Work In Arkansas How property taxes work in arkansas. Our arkansas property tax calculator can estimate your property taxes based on similar properties, and show you how your property tax. The amount of property tax owed is based on the assessed value of the property, which is determined by the county assessor. How do property taxes work in arkansas , though?. People who. How Do Property Taxes Work In Arkansas.

From www.youtube.com

Property Tax Explained How Do Property Taxes Work? YouTube How Do Property Taxes Work In Arkansas The median property tax in arkansas is $532.00 per year for a home worth the median value of $102,900.00. How do property taxes work in arkansas , though?. How property taxes work in arkansas. People who work for the county go around and. Counties in arkansas collect an. The amount of property tax owed is based on the assessed value. How Do Property Taxes Work In Arkansas.

From www.texasrealestatesource.com

How Do Property Taxes Work in Texas? Texas Property Tax Guide How Do Property Taxes Work In Arkansas Counties in arkansas collect an. How do property taxes work in arkansas , though?. The amount of property tax owed is based on the assessed value of the property, which is determined by the county assessor. The appraised value is equal to the. Property owners in arkansas have the legal obligation to pay property taxes every year. Property taxes are. How Do Property Taxes Work In Arkansas.

From www.thv11.com

Why we pay personal property taxes in Arkansas How Do Property Taxes Work In Arkansas People who work for the county go around and. Our arkansas property tax calculator can estimate your property taxes based on similar properties, and show you how your property tax. The amount of property tax owed is based on the assessed value of the property, which is determined by the county assessor. The median property tax in arkansas is $532.00. How Do Property Taxes Work In Arkansas.

From www.bonnierobertsrealty.com

How Does Property Tax Work? A Guide for New Homeowners Bonnie Roberts How Do Property Taxes Work In Arkansas Counties in arkansas collect an. Property owners in arkansas have the legal obligation to pay property taxes every year. How property taxes work in arkansas. The amount of property tax owed is based on the assessed value of the property, which is determined by the county assessor. The median property tax in arkansas is $532.00 per year for a home. How Do Property Taxes Work In Arkansas.

From zamp.com

Ultimate Arkansas Sales Tax Guide Zamp How Do Property Taxes Work In Arkansas The appraised value is equal to the. The amount of property tax owed is based on the assessed value of the property, which is determined by the county assessor. Property taxes are levied by local school districts and approved by the quorum court. How do property taxes work in arkansas , though?. The median property tax in arkansas is $532.00. How Do Property Taxes Work In Arkansas.

From www.dailysignal.com

How High Are Property Taxes in Your State? How Do Property Taxes Work In Arkansas Our arkansas property tax calculator can estimate your property taxes based on similar properties, and show you how your property tax. How property taxes work in arkansas. The median property tax in arkansas is $532.00 per year for a home worth the median value of $102,900.00. Property in arkansas is regularly appraised by professional appraisers that are designated by the. How Do Property Taxes Work In Arkansas.

From www.signnow.com

Tax Ar3 20162024 Form Fill Out and Sign Printable PDF Template How Do Property Taxes Work In Arkansas How property taxes work in arkansas. Property owners in arkansas have the legal obligation to pay property taxes every year. People who work for the county go around and. Property taxes are levied by local school districts and approved by the quorum court. Property in arkansas is regularly appraised by professional appraisers that are designated by the state. The median. How Do Property Taxes Work In Arkansas.

From www.youtube.com

How Do Property Taxes Work? YouTube How Do Property Taxes Work In Arkansas The median property tax in arkansas is $532.00 per year for a home worth the median value of $102,900.00. People who work for the county go around and. Property owners in arkansas have the legal obligation to pay property taxes every year. Counties in arkansas collect an. Our arkansas property tax calculator can estimate your property taxes based on similar. How Do Property Taxes Work In Arkansas.

From www.hrblock.com

Learn More About Arkansas Property Taxes H&R Block How Do Property Taxes Work In Arkansas Property in arkansas is regularly appraised by professional appraisers that are designated by the state. The amount of property tax owed is based on the assessed value of the property, which is determined by the county assessor. How property taxes work in arkansas. The appraised value is equal to the. Property owners in arkansas have the legal obligation to pay. How Do Property Taxes Work In Arkansas.

From www.taxpolicycenter.org

How do state and local property taxes work? Tax Policy Center How Do Property Taxes Work In Arkansas How do property taxes work in arkansas , though?. The median property tax in arkansas is $532.00 per year for a home worth the median value of $102,900.00. Property in arkansas is regularly appraised by professional appraisers that are designated by the state. People who work for the county go around and. The appraised value is equal to the. The. How Do Property Taxes Work In Arkansas.

From www.realestatespokane.com

Property Taxes 101 Information for Home Buyers How Do Property Taxes Work In Arkansas The median property tax in arkansas is $532.00 per year for a home worth the median value of $102,900.00. How do property taxes work in arkansas , though?. In arkansas, property taxes are based on the market value of a person's property. Property owners in arkansas have the legal obligation to pay property taxes every year. The appraised value is. How Do Property Taxes Work In Arkansas.